What Patients in SE Calgary Need to Know (and How It’s Different From the U.S.)

Dental insurance is one of the most misunderstood parts of oral healthcare in Canada. Many patients in SE Calgary delay treatment, avoid booking appointments, or feel anxious about costs—not because they don’t care about their teeth, but because they don’t fully understand how dental insurance actually works.

To make things more confusing, much of what people hear about dental insurance comes from U.S.-based information online. Unfortunately, the Canadian system works very differently.

At Toothcrew Family Dental in SE Calgary, we believe informed patients make better, more confident decisions. Let’s clear up the biggest myths and explain how dental insurance truly works in Canada—without the jargon or judgment.

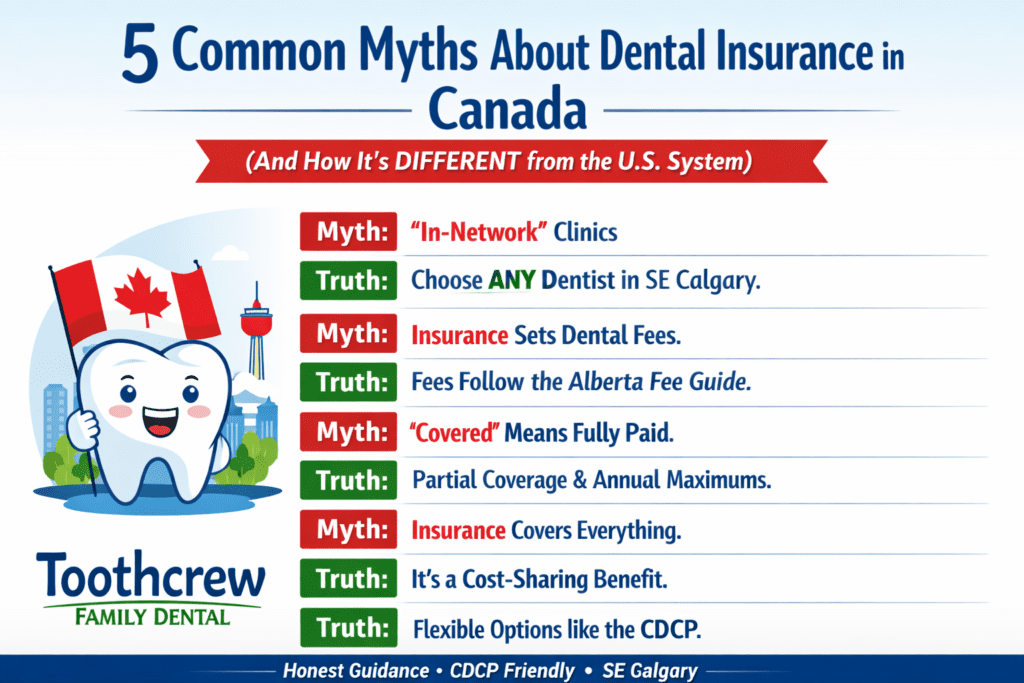

Myth #1: Dental insurance in Canada works like the U.S. “in-network / out-of-network” system

Truth: Canada does not have a true in-network dental system like the United States.

In the U.S., insurance companies create networks of dentists who agree to discounted fees. Patients often pay significantly more—or lose coverage entirely—if they visit an “out-of-network” provider.

In Canada, that model does not apply.

Instead:

You can visit any licensed dentist, including Toothcrew Family Dental

Insurance reimbursement is usually based on a provincial dental fee guide

Coverage depends on your plan, not on which clinic you choose

This means patients in SE Calgary are free to choose a dental clinic based on trust, comfort, and quality of care—not insurance restrictions.

👉 At Toothcrew Family Dental, we accept most Canadian insurance plans and help you understand your coverage before treatment begins.

Myth #2: Dental insurance companies decide how much dentists can charge

Truth: Dental insurance companies do not set dental fees in Canada.

Dental fees are guided by provincial dental associations, such as the Alberta Dental Association fee guide. These fee guides reflect:

Training and expertise required

Cost of modern dental technology

Time, materials, and safety standards

Insurance companies then decide:

What percentage they will reimburse

Which procedures are eligible

The annual maximum they will pay

If your plan reimburses below the current Alberta fee guide, the difference becomes your responsibility—not because the dentist overcharged, but because the plan didn’t keep pace.

👉 Toothcrew Family Dental follows provincial fee guidelines and provides clear, upfront estimates so there are no surprises.

Myth #3: If a treatment is “covered,” insurance pays the full cost

Truth: “Covered” does not mean “fully paid.”

Most Canadian dental plans include:

Deductibles

Co-payments (often 20–50%)

Annual maximums (commonly $1,000–$2,500)

For example:

A cleaning may be covered at 80–100%

A filling might be covered at 70–80%

A crown could be covered at 50%—or not at all, depending on the plan

Once you reach your yearly maximum, insurance stops paying, even if more treatment is needed.

👉 At Toothcrew Family Dental in SE Calgary, we explain what insurance is likely to cover and help you plan care around your benefits.

Myth #4: Dental insurance is meant to fully protect you from dental costs

Truth: Dental insurance in Canada is a cost-sharing benefit, not comprehensive coverage.

Unlike medical care under Canada’s public healthcare system, dental care is largely private. Dental insurance is designed to:

Encourage regular checkups and cleanings

Reduce out-of-pocket expenses

Support preventive care

It is not designed to fully cover complex or long-term dental needs such as crowns, root canals, or gum therapy.

Understanding this helps patients avoid disappointment and plan more realistically.

👉 At Toothcrew Family Dental, we focus on prevention and early care to help reduce the need for more costly treatment later.

Myth #5: If you don’t have employer insurance, dental care isn’t affordable

Truth: Not having private insurance does not mean you can’t receive dental care in SE Calgary.

Many patients assume they must delay treatment until they have insurance—but delaying often leads to bigger, more expensive problems.

Options may include:

Phasing treatment over time

Prioritizing urgent or essential care

Using Health Spending Accounts (HSA)

Accessing the Canadian Dental Care Plan (CDCP) if eligible

Transparent treatment planning with no pressure

👉 Toothcrew Family Dental has extensive experience helping patients navigate the Canadian Dental Care Plan and understand what is covered and what may require pre-authorization.

Why understanding dental insurance matters for SE Calgary families

SE Calgary is home to families, seniors, professionals, and newcomers—many with different types of insurance or none at all. Misunderstanding dental coverage often leads to:

Skipped checkups

Untreated pain

Anxiety or embarrassment about booking appointments

Bigger expenses down the road

Clear information empowers patients to take control of their oral health without fear or shame.

At Toothcrew Family Dental, we pride ourselves on being:

Judgment-free

Transparent about costs

Supportive of patients who’ve delayed care

Focused on education, not pressure

Choose a dentist who helps you understand your benefits

Dental insurance should never feel intimidating. A good dental clinic doesn’t just treat teeth—it helps patients understand their options.

If you’re looking for a trusted dentist in SE Calgary who will:

Explain your insurance clearly

Help maximize your benefits

Offer judgment-free care

Support CDCP patients

Provide honest treatment planning

👉 Toothcrew Family Dental is here to help.

📞 Call us at 587-358-3333

📍 Conveniently located in SE Calgary

🦷 Accepting new patients | Families | CDCP patients